Key Indian benchmark indices manage to pull back from day's low on Wednesday

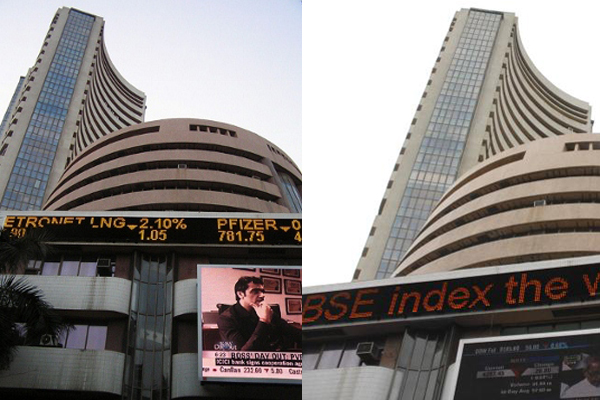

Mumbai, Mar 14 (IBNS): Key Indian benchmark indices ended in negative territory on Wednesday but managed to pull back from the day's low, according to media reports.

BSE Sensex was down 21.04 points at 33,835.74 and NSE Nifty was down 16 points at 10,410.9o.

Top gainers included Tech Mahindra, Ambuja Cements, Axis Bank, SBI, ICICI Bank, Yes Bank, Maruti Suzuki, Bajaj Finance and UltraTech Cement while Bharti Infratel, Bhartii Airtel, HDFC, HPCL, Hero Motocorp, ONGC and Tata Steel were some of the key stocks that declined.

Meanwhile, wholesale inflation in India eased to a seven-month low of 2.48 per cent in February, according to a release issued by the Union Ministry of Commerce and Industry on Wednesday, largely due to cheaper food articles, including vegetables.

The previous low level 1.88 per cent was recorded in July

On the basis of Wholesale Price Index (WPI), inflation was 2.84 per cent in January this year and 5.51 per cent in February 2017.

Build up inflation rate in the financial year so far was 2.30 per cent compared to a build up rate of 4.92 peer cent in the corresponding period of the previous year, the release said.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.