Stock Market

Stock Market

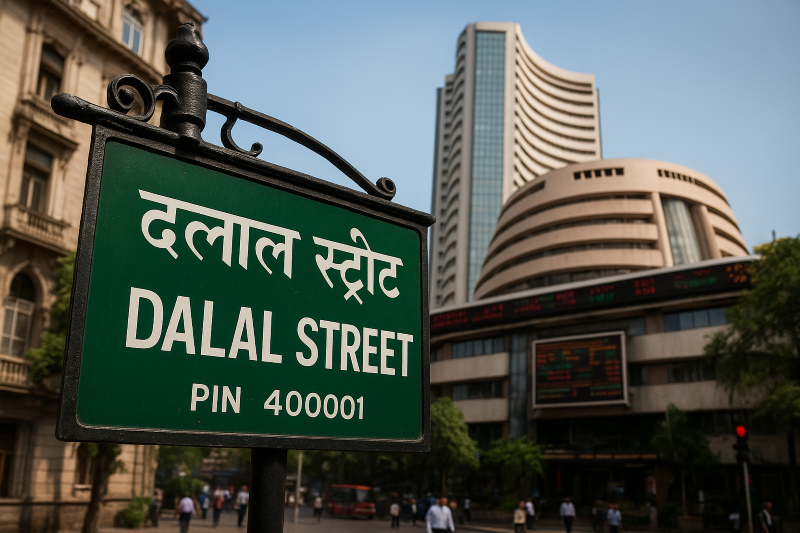

Sensex jumps 150 points at open, Nifty holds 26,000 — PSU and metal stocks lead market rebound

Mumbai/IBNS: Indian equity benchmarks opened on a positive note on Wednesday, with the BSE Sensex rising nearly 150 points in early trade, media reports said.

The benchmark index sustained its gains even after an hour of trading, while the NSE Nifty 50 stayed comfortably above the 26,000 mark.

The market’s positive momentum was driven by strong buying in PSU bank and metal stocks, helping indices recover losses from the previous four consecutive sessions.

Among individual stocks, Tata Steel and Bharat Electronics Ltd (BEL) gained around 2 percent each. RITES shares surged nearly 7 percent after the company secured an international locomotive supply order worth $3.6 million.

HFCL (up 8.14%), IFCI (7.55%) and Jupiter Wagons (6.54%) emerged as the top gainers in morning trade.

On the downside, Asahi India Glass fell 3.69%, followed by Aditya Birla Sun Life AMC (down 2.70%) and Navin Fluorine International (down 2.57%).

Hindustan Copper shares declined about 3% as metal prices slipped nearly 1% amid year-end profit booking, according to an Economic Times report.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.