Conference Board of Canada predicts oil industry losing another $1.1B this year

Carlos A. Murillo, board economist, predicted that an increased global demand and continuous upsurge of oil prices would result in Canadian oil companies’ loss of a cumulative $1.1 billion Cdn before taxes in 2017, although better than the $8.6 billion lost in 2016, but still concerning.

Global oil demand is expected to increase by two million barrels a day this year, surpassing an expected growth in supply of 1.3 million barrels which will lead to increase in oil prices and decrease in profit in the oil industry.

2014’s drop in oil prices was due to oversupply but this year’s demand far exceeds the supply resulting in the increase in oil prices.

Oil prices have increased from $40 a barrel in 2016 to over $50 a barrel for most of 2017 and expected to increase to an average price of $55 per barrel for the year and will spike to $71 a barrel by 2021.

Pipeline developments projects offer good news for the oil sector.

Enbridge's Line 3 replacement and Kinder Morgan's Trans-Mountain expansion projects would add a million barrels a day and The Keystone XL and Energy East projects would add another two million barrels of capacity to Canada's pipeline network and would enable the increased availability of products in market.

Although Pipeline developments projects offer good signs for the growth of oil sector, the reality of present situation is that there is great need for new capacity and it will be some time before the increased market access of products and better prices for the industry will materialize.

(Reporting by Asha Bajaj)

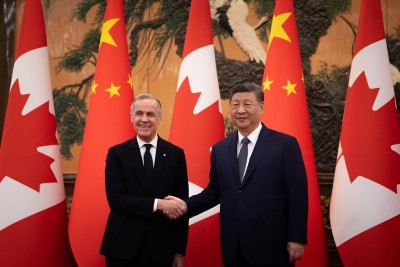

Image Canada’s Oil industry: Wikipedia

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.