Oct 10, 2024, at 02:02 am

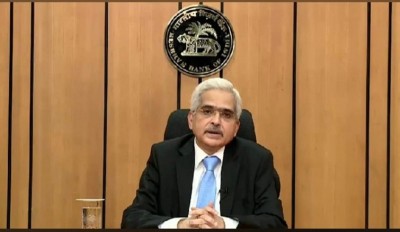

Mumbai: The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC), in its meeting held from October 7 to 9, announced on Wednesday that the benchmark repo rate will remain steady at 6.5 percent.

RBI's 3-day MPC meeting starts

Apr 04, 2024, at 06:40 am

Mumbai: The Reserve Bank of India's Monetary Policy Committee has started its three-day meeting on Wednesday to deliberate on interest rates and analyze the state of the economy.

Banks and financial institutions welcome RBI's 'surprise' move to pause repo rate hike for now

Apr 07, 2023, at 05:22 am

Mumbai/IBNS: The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) on Thursday decided to keep the repo rate unchanged at 6.5%. This came as a big relief as most experts had opined that the apex bank should take a pause amid global economic uncertainties and the economy has reached a saturation point beyond which it may be difficult to absorb any more rate hikes.

Former RBI Gov Raghuram Rajan says central bankers should gear up for low inflation: Report

Dec 03, 2022, at 06:21 am

Former Reserve Bank governor Raghuram Rajan Friday warned that the global economy could go back to a low inflation regime and central bankers implementing restrictive monetary policies should keep that in mind, according to a Bloomberg report.