Loan

Loan

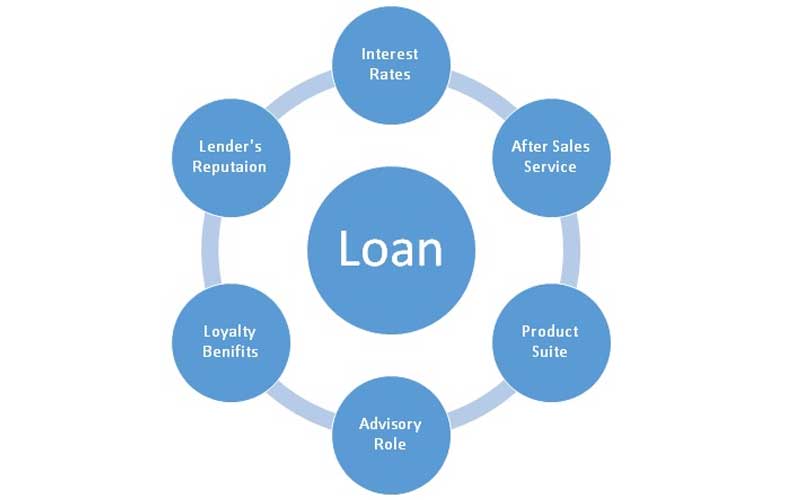

Things to Keep in Mind While Choosing the Right Lender for Two Wheeler Finance

Digitisation of financial services has drastically changed the way lenders work with and perceive customers. Those days when a high wall existed between lenders and customers, and applying for a loan involved a lot of paperwork and hassle, is now over. Today, lenders act as facilitators and as solution providers while engaging with customers, to build a good relationship. You, the customer, is indeed the king, and you can make a choice from a variety of lenders for your two wheeler finance. If you are availing a credit line to finance it, you are inadvertently entering a long-term agreement with your lender and you want to be sure you do not get any unpleasant surprises later on. So here are some tips to help you choose the right lender for financing your two wheeler.

Does the lender provide a rewards programme?

A strong credit score helps you get approval for a two-wheeler loan from a lender faster. In case you have a low credit score, make sure you find a lender who works with you to help improve your credit score while lending. A few lenders have instituted a rewards programme for customers who pay off their loans according to the loan conditions. The lender who implements the rewards programme deposits a certain percentage of the loan you have paid back into a small account, which continues to grow over a period of time.

Compare rates of different lenders

A high interest rate or a high annual percentage rate (APR) is not any borrower’s willing choice. Interest rate is a way to gauge your monthly costs, whereas the APR gives you a big-picture estimate of the cost of the loan. Make sure to do some research and compare the rates of different lenders to get the most benefit while opting for two wheeler finance. Do not go for a lender that is charging a high APR because you may get trapped in a cycle of missed payments. And this in turn can decrease your credit score.

Referrals are important

While payment rates and credit scores are important, do not undermine the importance of referrals, which can help you find the right lender to match your needs. You can learn more about lenders by asking around and getting suggestions from friends, co-workers, your extended family, or by scanning advertisements. You can also look up a company’s social media sites and go through the comments section to know what people are saying about them to help you make the right choice for a two wheeler lender.

Ascertain the fee structure

Due to a general lack of financial awareness among Indians, many borrowers focus only on the interest rate that the lender will charge for your two wheeler loan, but conveniently forget to factor in other parameters. You should remember that the best interest rates may not necessarily mean the best service standards. While making an evaluation of a lender, there are many other parameters you should consider. You need to make sure that the lender is upfront about the fee structure he is charging you, and if he is evasive, then it is a clear indication that you should not opt for him.

After sales service

You may think that in case of two wheeler finance, after sales service is not important since the loan amount is not very large. But this is where you are wrong. If you are availing an easy or affordable two wheeler loan, after sales service is particularly important. The responsiveness to customer queries and service standards after the sale has been closed is of supreme importance, since if you run into financial troubles, you may like to foreclose your two wheeler loan or you may like to alter the repayment clause on your original agreement. You should be particularly concerned about the modes of open communication, service level agreements, turnaround time and self help online accounts.

Product suite and advisory role

It is important that the lender you choose for two wheeler finance provides a range of financial services. While seeking out the right lender, avoid concentrating only on the interest rate. You should also enquire if the lender is equipped to support your other financial goals and can help you to frame a financial path and help you with the right investment products along the way. This way, you can get comprehensive services and leverage the relationship more effectively from a financial institution.

Reputation of the lender

In this digital and hyper-connected world, it is easy to check out the credentials and reputation of the lender online. You can check out many online forums that can lead you to real customers who can testify and give you an objective opinion. It is also a smart move to have a face-to-face interaction with friends and family members who have availed of a two wheeler loan from the financial institution you have shortlisted and assess his or her satisfaction levels with the service standards. Usually, a well established and large financial institution that has been operating for a long time, has a better reputation.

Finally, to determine if your lender is a strategic partner for two wheeler finance, you need to ask yourself some basic questions:

--Have you carefully determined which lender you should use to finance your two wheeler asset?

--Have you defaulted on EMI repayments with your current bank group?

--Does your lender work with you throughout your planning and asset replacement process?

--Does your lender give you guidance for asset specifications?

--Does your current lender work to help you maximize the resale value of your two wheeler asset?

All in all, a little bit of research, homework and curiosity can go a long way in helping you decide on the right lender for your two wheeler finance. So, make the right choice as far as your lender is concerned by exercising your rights intelligently as an aware borrower.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.