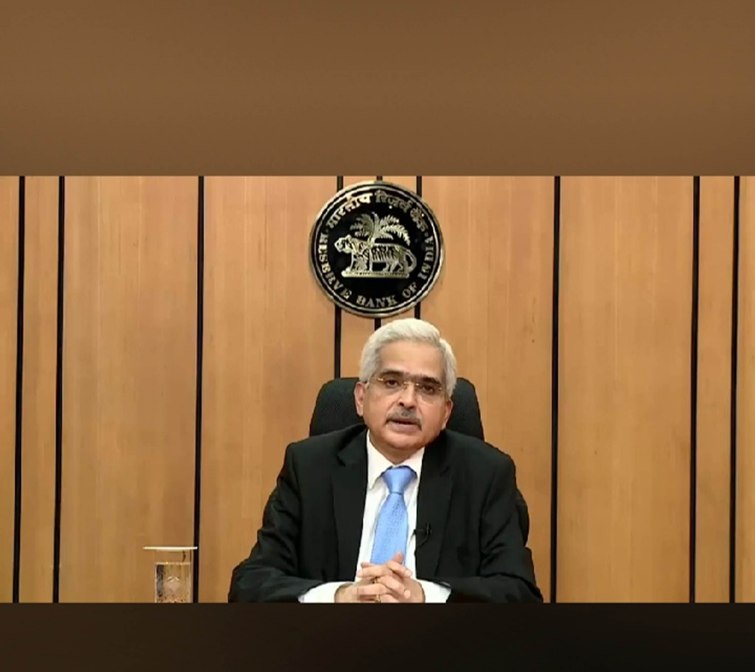

RBI's Covid-19 solutions well thought; monetary policy stance will continue to be accommodative: Shaktikanta Das

Mumbai/IBNS: The Reserve Bank of India’s (RBI) framework for Covid-19 solutions is well thought and taken after due consultations, Governor Shaktikanta Das said Thursday, adding that the central bank’s response to COVID-19 is unprecedented.

In his keynote address at ‘Unlock BFSI 2.0’ today, Das said RBI is taking a long term view of the resolutions and measures and will have a very cautious exit plan.

The Governor said "RBI will not unwind any measures immediately".

He said the Indian banking sector continues to be sound and stable; however, it is obvious that the Covid-19 pandemic will put pressure on the balance sheet of banks and lead to erosion of their capital.

In this situation, what becomes more important is how banks proactively respond to this challenge, he said, adding that the RBI has already asked banks and NBFCs to conduct a Covid stress test.

Das said the banks need to focus on sunrise sectors while supporting those sectors which have the potential to bounce back and the risk management systems should be able to “smell vulnerabilities in businesses in advance”.

In a fireside chat following his keynote address, the RBI Governor said amid the uncertainty and fast-changing situations triggered by the Covid-19 pandemic, it cannot be assured that any growth projection will not change in a month, reported media.

He said RBI does not have the luxury to make estimated growth projections today and change the figures a month later.

Only after there is some amount of clarity about the COVID-19 curve and other aspects related to the pandemic, the RBI will start giving out growth numbers.

In view of the stress in the economy triggered by Covid-19, RBI’s monetary policy stance will continue to be accommodative, Das said, adding that the central bank has “not exhausted its ammunition on rate cuts or policy actions”, reported media.

Amid the trying times, fiscal deficit, current account deficit, and Debt-to-Gross Domestic Product (GDP) ratio are in a much better state this time, he said, added media reports.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.