RBI

RBI

RBI increases repo rate by 50 basis points

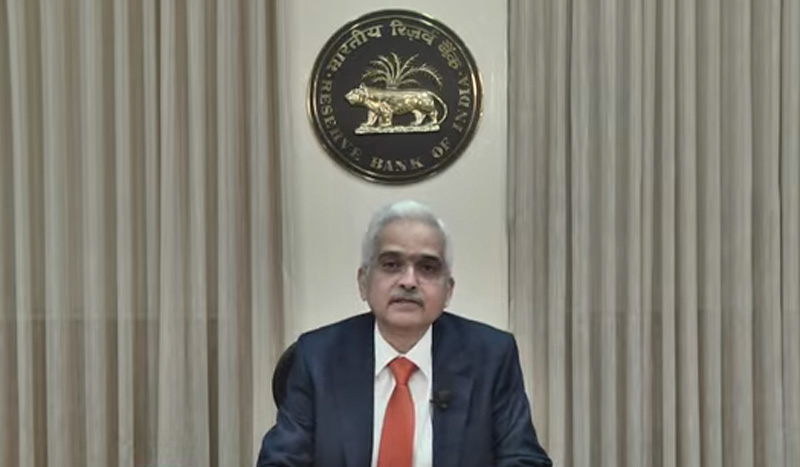

Mumbai: RBI Governor Shaktikanta Das on Friday said the central bank's Monetary Policy Committee (MPC) has hiked the repo rate by 50 basis points (bps).

The hike has led the figure to touch a three-year high of 5.9 percent.

In his address, Das said: "The global economy is in eye of storm."

He said despite the situation, India has so far withstood shocks over the last two years.

Additional Measures:

The Governor announced a series of four additional measures, as given below.

Discussion paper on Expected Loss-Based Approach to be released for loan-loss provisioning by banks

Banks currently follow incurred-loss approach, where provisions are made after stress has actually materialized, this is to be replaced by a more prudent approach which requires banks to make provisions based on assessment of probable losses.

Discussion paper on securitization of Stressed Assets Framework (SSAF) to be released.

Revised framework for securitization of stressed assets was issued in Sep 2021, it has now been decided to introduce a framework for securitization of stressed assets, this will provide alternate mechanism for securitization of NPAs in addition to existing ARC route.

Internet banking facility for customers of Regional Rural Banks.

RRBs are currently allowed to provide internet banking facility to customers subject to fulfillment of certain criteria, to spread digital banking in rural areas, these criteria are being rationalized, revised guidelines to be issued separately.

Regulation of offline payment aggregators.

Online Payment Aggregators (PAs) have been brought under the purview of RBI regulations since March 2020. It is now proposed to extend these regulations to offline PAs, who handle proximity/ face-to-face transactions. This measure is expected to bring in regulatory synergy and convergence on data standards.

Growth Projection – 7.0% for 2022-23

The Governor informed that the central bank’s growth projection for the Indian economy for 2022-23 is projected at 7.0 per cent with Q2 at 6.3 per cent; Q3 at 4.6 per cent; and Q4:2022-23 at 4.6 per cent, with risks broadly balanced.

The growth for Q1 of 2023-24 is projected at 7.2 per cent.

Against the current challenging global environment, economic activity in India remains stable, stated the RBI Governor. "While real GDP in first quarter of this year turned out to be lower than expectations, it is perhaps the highest among major global economies", he added.

Inflation

Inflation inched up to 7.0 per cent in August from 6.7 per cent in July, stated the RBI Governor. Global geopolitical developments are weighing heavily on the domestic inflation trajectory, he said.

The RBI Governor stated that monetary policy has to carry forward its calibrated action on policy rates and liquidity conditions consistent with the evolving inflation growth dynamics. It must remain alert and nimble, he stated.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.