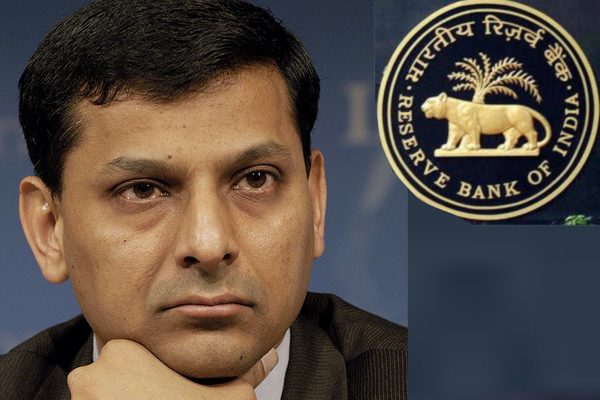

Raghuram Rajan warns of inflation risks during the third Bi-monthly Monetary Policy Statement

The report said that it has been decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.5 per cent; keep the cash reserve ratio (CRR) of scheduled banks unchanged at 4.0 per cent of net demand and time liabilities (NDTL); and to continue to provide liquidity as required but progressively lower the average ex ante liquidity deficit in the system from one per cent of NDTL to a position closer to neutrality.

Consequently, the reverse repo rate under the LAF will remain unchanged at 6.0 per cent, and the marginal standing facility (MSF) rate and the Bank Rate at 7.0 per cent.

In his opening statement at the post-policy press conference, Rajan said, "As you will note from the policy statement, we have kept rates on hold, maintaining an accommodative stance while we await developments. We are within the inflation band given to us by the Government and expect to be around 5 percent CPI inflation by March 2017, absent unforeseen eventualities."

The policy statement highlighted that since the second bi-monthly statement of June 2016, several developments have clouded the outlook for the global economy.

Across advanced economies (AEs), growth in the second quarter of 2016 has been slower than anticipated, and the outlook is still mixed.

Headwinds in the United States from declining inventory investment were offset somewhat by strong payroll numbers.

In the Euro area, the re-emergence of stress in some parts of the banking sector and the Brexit vote increased uncertainty.

In Japan, downside risks have intensified in the form of a stronger yen, deflationary risks and contracting industrial production, triggering monetary and fiscal stimuli.

Among emerging market economies, activity remains varied. GDP growth stabilised in China in Q2, on the back of strong stimulus. Manufacturing activity was weak in July due to adverse weather and subdued export demand, although smaller firms recorded an uptick in new orders. Recessionary conditions are gradually diminishing in Brazil and Russia, but the near-term outlook is still fragile due to policy uncertainties and soft commodity prices.

On the domestic front, several factors are helping to support the recovery, according to the policy statement.

After a delayed onset, the south west monsoon picked up vigorously from the third week of June. By early August, the cumulative rainfall was 3 per cent higher than the long period average, with more than 80 per cent of the country receiving normal to excess precipitation. Kharif sowing strengthened after a lacklustre start, particularly with respect to pulses. Barring cotton, jute and mesta, sowing of all crops is currently above last year’s acreage. These developments engender greater confidence about the near-term outlook for value added in agriculture. The target for kharif production set by the Ministry of Agriculture appears within reach, said Rajan.

Governor Rajan said that a larger share of the policy statement than usual was devoted to a discussion of liquidity, and how the central bank sees it going forward.

"As we have reiterated in the past, we do not see the FCNR(B) repayments as disruptive. With the preparation we have made, and good management, redemptions should go smoothly. More generally, the new liquidity framework announced in the April policy is being implemented. We have reduced some of the structural liquidity deficit. However, the current surplus is partly because of seasonal factors and not because we have eliminated the structural deficit. To emphasize this point, we announced an Open Market Purchase today. The RBI will proceed in a calibrated way towards the goal of eliminating the structural deficit. When we have done so, episodes of systemic surplus and systemic deficit should be evenly balanced," Rajan said.

The policy statement also mentioned that the recent sharper-than-anticipated increase in food prices has pushed up the projected trajectory of inflation over the rest of the year. Moreover, prices of pulses and cereals are rising and services inflation remains somewhat sticky. There are early indications, however, that prices of vegetables are edging down.

Going forward, the strong improvement in sowing on the back of the monsoon’s steady progress, along with supply management measures, augers well for the food inflation outlook.

The prospects for inflation excluding food and fuel are more uncertain; if the current softness in crude prices proves to be transient and as the output gap continues to close, inflation excluding food and fuel may likely trend upwards and counterbalance the benefit of the expected easing of food inflation.

In addition, the full implementation of the recommendations of the 7th central pay commission (CPC) on allowances will affect the magnitude of the direct effect of house rents on the CPI.

"The stance of monetary policy remains accommodative and will continue to emphasise the adequate provision of liquidity. Easy liquidity conditions are already prompting banks to modestly transmit past policy rate cuts through their MCLRs and pro-active liquidity management should facilitate more pass-through." he said.

The Governor also announced that on August 25, the RBI will unveil a set of measures to improve the functioning of markets, especially the corporate bond markets. Some of these measures will build on suggestions in the recent Khan Committee report.

Raghuram Rajan also said that he hopes the next monetary policy statement will be by the proposed Monetary Policy Committee (MPC) as the committee to select outside members of the MPC has commenced the process.

On the RBI’s side, the Board has selected Dr. Michael Patra to be the RBI Board nominee on the MPC. The other two members from the RBI will be the Governor and the Deputy Governor in charge of monetary policy.

According to Rajan, with the formation of the MPC, the Government and the RBI will have completed a fundamental institutional reform, which modernizes India’s monetary policy framework and builds a platform for strong and sustainable growth. "Some of the collateral benefits over and above low inflation will be a currency that is not depreciating constantly, higher real returns earned by savers, and lower nominal interest rates, including inflation risk premia, paid by borrowers," he added.

Raghuram Rajan signed off his post-policy conference by saying that the RBI is embarking on an year-long public awareness and consumer protection campaign.

One of the major campaign is about easing the Know Your Customer or KYC in the banking system, which has been a source of harassment for ordinary customers. While KYC norms have been considerably simplified, not all banking branches are aware of them.The applicable KYC rules can now be accessed from the RBI’s web page – there is a bar you can click on entitled “FAQs for KYCs”. For instance, if you move, your new address can be self-certified and you do not need proof of new address. "If your branch does not know these simplified norms, please go to the RBI webpage and point it out to them. You will be doing a public service," the governor said.

Another key message was the spurious mails that many people receive purportedly from the RBI.

"If you get an email from me or any future governor promising to transfer a large sum of say rupees 50 lakh to you if only you send a small transaction fee of rupees 20,000 to a specific bank account, delete the email. The reality is such emails are not from me and the RBI does not give out money directly to ordinary citizens, even though we print plenty of it. While the emails usually contain very convincing reasons why you have been chosen to receive money, ask yourself why I cannot simply deduct rupees 20,000 and send you rupees 49.8 lakh. If you think for a moment, you should not fall prey to such emails," reminded Raghuram Rajan.

The fourth bi-monthly monetary policy statement will be announced on October 4, 2016.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.