Bharat Ratna

Bharat Ratna

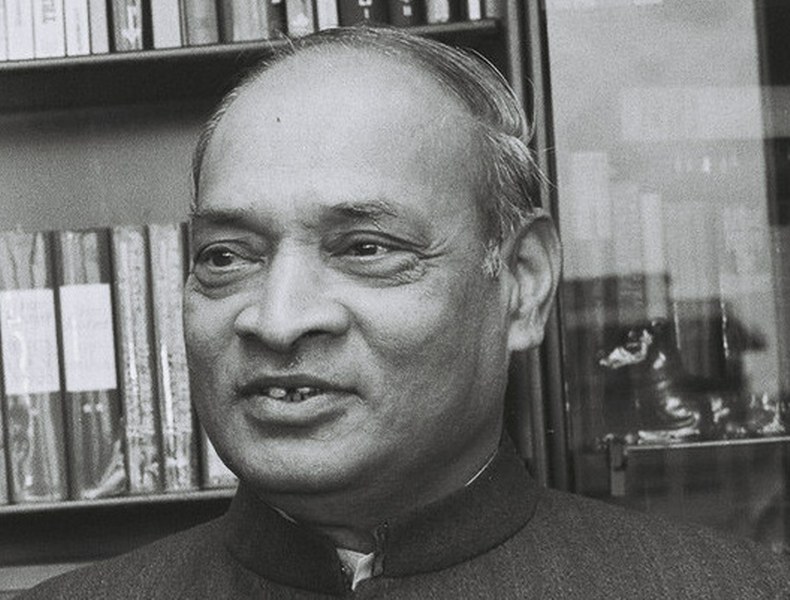

PV Narasimha Rao: The Prime Minister who steered India through economic crisis with bold leadership

New Delhi: The Narendra Modi government on Friday announced Bharat Ratna for former Prime Minister PV Narasimha Rao posthumously. The honour is seen as a befitting tribute by the nation to the a prime minister of Congress outside the Nehru-Gandhi family.

Delighted to share that our former Prime Minister, Shri PV Narasimha Rao Garu, will be honoured with the Bharat Ratna.

— Narendra Modi (@narendramodi) February 9, 2024

As a distinguished scholar and statesman, Narasimha Rao Garu served India extensively in various capacities. He is equally remembered for the work he did as… pic.twitter.com/lihdk2BzDU

Born on June 28, 1921, in Vangara, Andhra Pradesh, Rao's tenure witnessed several historic events, including the epoch-making 1991 economic reforms, the Babri Masjid demolition, and the 1993 Latur earthquake.

Often called the first BJP prime minister of India by the likes of Mani Shankar Aiyar (despite being a Congressman) for allegedly not acting to prevent the demolition of the Babri Masjid, PV Narasimha served as the 9th prime minister of India from 1991 to 1996.

He actively participated in India’s freedom struggle and joined full-time politics after India achieved freedom in 1947. Known for his scholarly pursuits and linguistic abilities, Rao held several ministerial portfolios successfully in Andhra Pradesh.

Although Rao played a crucial part in India's economic evolution, his impact has been clouded by internal party dynamics. While he is often credited for the economic reforms, often attributed to Manmohan Singh, it has sparked debates and controversies.

Rao is often referred to as the 'Father of Indian Economic Reforms’.

While some recognize Rao's decisive leadership and influence on India's development, others criticize his management of social security during the Babri Masjid demolition.

Image Credit: wikipedia.org

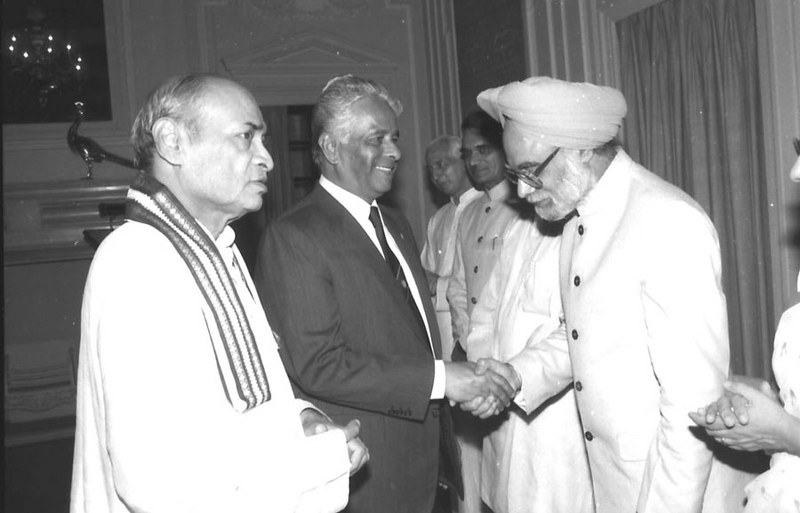

Image Credit: wikipedia.org

Rao appointed a non-political economist Manmohan Singh, a former governor of the Reserve Bank of India, as his Finance Minister, breaking a convention, as the post till then had been always held by a politician.

In 1991, India was in the face of an economic crisis. To avoid this, the Narasimha Rao government initiated reforms, primarily focusing on opening up to foreign investment, restructuring capital markets, easing domestic business regulations, and revamping trade policies.

Rao's government aimed to curb the fiscal deficit, privatize public enterprises, and enhance investments in infrastructure.

Trade reforms and alterations in foreign direct investment regulations were introduced to integrate India into global trade while stabilizing external debts.

He teamed up with Finance Minister Manmohan Singh and formed strategies that rescued India from an economic meltdown and ushered in the era of liberalization of the Indian economy by welcoming foreign investments.

During Rao's tenure, major reforms were implemented in India's capital markets, which led to substantial foreign portfolio investments.

In 1992, the Controller of Capital Issues, which had previously dictated share prices and issuance quotas for firms, was abolished.

In another major reform, the SEBI Act of 1992 was enacted and the Security Laws (Amendment) Act granted legal authority to SEBI to register and regulate all security market intermediaries.

India's equity markets were opened to foreign institutional investors in 1992, and Indian firms were permitted to raise capital internationally through Global Depository Receipts (GDRs).

The National Stock Exchange in 1994 was established as a computer-based trading platform, marking a significant milestone, becoming India's largest exchange by 1996.

Tariffs were reduced manifold from an average of 85% to 25%, and quantitative controls were rolled back, while the rupee was made convertible on trade accounts.

Foreign direct investment was encouraged by increasing the maximum foreign capital share in joint ventures and allowing 100% foreign equity in priority sectors.

Procedures for FDI approvals were streamlined, allowing automatic approval for projects within foreign participation limits in at least 35 industries.

These reforms left a deep impact on the Indian economy, which became evident in the remarkable growth of total foreign investment in India. This included foreign direct investment, portfolio investment, and capital raised on international markets, which surged from a mere US$132 million in 1991–92 to $5.3 billion in 1995–96.

Rao initiated industrial policy reforms focusing on the manufacturing sector in the beginning. He reduced industrial licensing to a great extent, retaining only 18 industries subject to licensing, while rationalizing industrial regulation.

Exhibiting leadership and foresight, Rao did not fear to adopt bold policies at a time when the country was going through a troubled phase.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.