Need comprehensive and sustainable pension system in India: FICCI-KPMG

"This translates into the challenge of only a very small portion of the Indian working population being protected against old-age income insecurity. Further, the population projections suggest that the elderly residents (people aged 60 and above) will triple from 2010 to 2050 and the number of elderly will reach 331 million in India by 2050. A combination of aging population, weakening of the joint family support system and low pension penetration makes it imperative for policymakers to pay urgent attention to the enormous challenge of providing income security after retirement," it stated.

The aspiration of a pensioned society would need greater emphasis on implementing pension reforms. A lot of effort and planning is needed for building sufficient capacity, scalability and support for implementation of such reforms.

For the knowledge paper, KPMG in India again conducted an Employer Pension Plans Survey this year similar to the survey conducted in the year 2015, to have an overview of the pension plans from company representatives from diverse sectors (industrial markets, IT/BPO, automotive, healthcare, financial services, consumer markets, etc.). In all, 167 business entities responded to the survey.

The survey highlights that a majority of the employers are of the view that more emphasis needs to be given towards employees’ retirement planning. The survey responses indicate that tax benefits are considered as the primary reason to opt for NPS similar to the results of Employer Pension Plans Survey of 2015. A majority of respondents felt that the contribution towards retirement savings should be in the range of 20-30 percent of one’s salary.

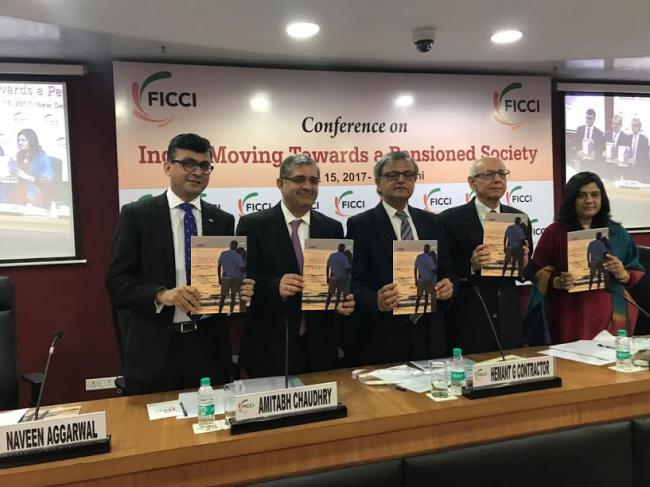

“Social security for the old age is an important issue in the public policy discourse of any country. In India, this has been high on the priority list of the government that has taken a series of measures to extend the reach of social security net. FICCI has also identified pensions as a key area for its work and is engaged with all the stakeholders to evolve policies that can help the growth of this sector. The FICCI-KPMG knowledge paper released on the occasion of our Pensions Conference is a good reference tool that provides information on the priorities of the Indian corporate sector with regard to pension planning for employees. We hope that this paper will prove to be a key input in policy discussions in this important area,” said Dr. A Didar Singh, Secretary General, FICCI.

“Given the large gap in pension coverage, both the regulators, EPFO and PFRDA, along with the government and industry need to collaborate and build a comprehensive and sustainable pension system in India. Significant efforts are required for building sufficient institutional capacity for implementing pension reforms in India,” said Parizad Sirwalla, Partner and Head, Global Mobility Services, Tax, KPMG in India.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.