Market experts divided on RBI's choice to maintain key policy rate

New Delhi: As widely anticipated by financial markets and policy observers, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) opted to maintain the policy repo rate at its current level of 6.50 percent during its meeting on Thursday.

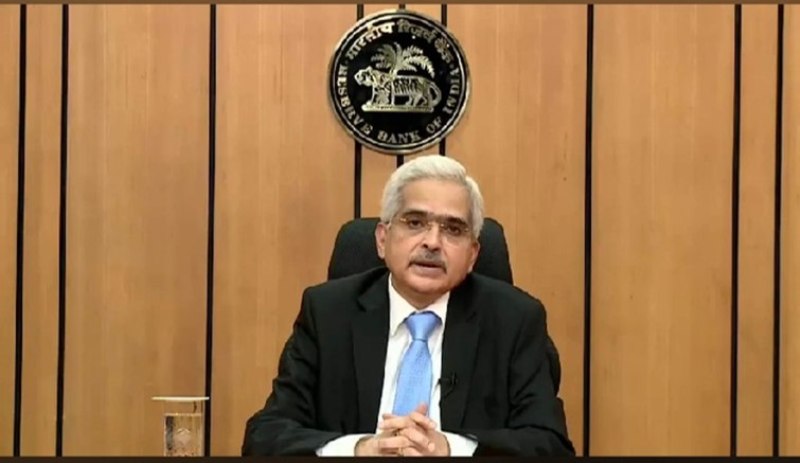

RBI Governor Shaktikanta Das, while delivering the bi-monthly monetary policy statement, announced, "After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the Monetary Policy Committee (MPC) decided by a 5 to 1 majority to keep the policy repo rate unchanged at 6.5 percent.

"Consequently, the standing deposit facility (SDF) rate remains at 6.25 percent, and the marginal standing facility (MSF) rate and the bank rate are at 6.75 percent.”

Furthermore, the MPC, with a majority vote of 5 out of 6 members, reaffirmed its commitment to gradually withdrawing policy accommodation to ensure that inflation progressively converges with the target while still fostering growth.

Bandhan Bank’s Chief Economist and Head of Research Siddhartha Sanyal said the Status quo in the repo rate in today’s MPC meeting was no surprise. One does not expect the repo rate to be lowered quickly, say for another six months. Legroom for the repo rate from the current 6.50% is limited. Also, a prudent central bank will likely refrain from a rate cut around a major political event like the general election. Most of the major global central banks also appear to be cautious to start easing policy rates.”

If the RBI’s CPI forecasts come true, clarity about headline CPI inflation softening to a 4%-handle should emerge by Q2 of 2024-25 – that should offer the MPC the flexibility to cut the repo rate and maintain a real interest rate that is better aligned with their long term policy objective.

Also, given that the US Fed seems to be inclined to cut their policy rates only in May 2024, if not later, the RBI will likely prefer rather cautious approach in terms of starting the rate easing cycle; after all, the Indian rate cutting cycle might be quite a shallow one.

One feels that the case for a change in policy stance to “neutral” from the current “withdrawal of accommodation” is stronger now. While that did not take place in February, the expectations of a change in the policy stance will likely be strong in the coming meetings.

Amid widespread concerns about liquidity tightness, the RBI’s communication suggested that stepping up government spending should help to infuse liquidity in the banking system. We continue to believe that in case of a need for the banking system, especially towards the end of the financial year, the RBI may provide liquidity support in a nuanced fashion. A preferred option for RBI can be to extend the tenor of variable rate repo (VRR) auctions – say, up to 28 days. It will mean a flexible and measured infusion of liquidity, offering banks more durable liquidity and, thereby, better control over their liquidity management efforts.

Interestingly, the RBI came out with further upward revisions in growth projections for the upcoming financial year. If the economy indeed grows at 7% during 2024-25, India looks set to emerge as the fastest-growing large economy by a distance. Such a strong uptick in growth along with broadly anchored inflation will provide greater policy cushion for the MPC.

ICRA Analytics Head Market Data Ashwini Kumar said, “The Indian mutual fund industry, which has witnessed around 26.72 percent growth in Assets under Management (AUM) since the beginning of this financial year at Rs 52.74 lakh crore in January 2024, up from Rs 41.62 lakh crore in April 2023, is likely to sustain its growth momentum in the coming quarters backed by strong macroeconomic fundamentals of the Indian economy and resilient earnings growth.

“The AUM, which crossed the halfway mark of the targeted Rs 100 lakh crore in December 2023, is poised for further growth backed by a steady rise in inflows across asset classes. Strong macroeconomic fundamentals of the Indian economy coupled with the possibility of an interest rate cut by the Reserve Bank of India if inflation remains under control, are some of the key factors that are expected to aid market sentiments moving forward.”

Bandhan AMC Head – Fixed Income Suyash Choudhary said, “RBI / MPC kept all rates unchanged as expected. The surprise here was rather external MPC member Prof. Varma voted for a 25 bps rate cut. The market was more looking forward to any dilution in the stance of policy, given the context of softer-than-expected recent CPI prints and the government’s commitment to significant fiscal consolidation in the recent budget. In the event, the Governor didn’t yield much on the stance, which was retained as ‘focused on the withdrawal of accommodation’. As expected, Prof. Varma dissented. As not expected, Dr. Goyal didn’t.”

Pankaj Pathak, Fund Manager- Fixed Income, Quantum AMC termed RBI’s approach as a “do-nothing policy”. “There was some disappointment for the market as a section of the market including us was expecting at least a stance change from ‘withdrawal of accommodation’ to ‘neutral.’ In justification of the ‘withdrawal of accommodation’ stance, the governor linked the stance to the RBI’s inflation target and policy transmission,” he said.

On inflation, the RBI seems more worried about volatile food prices and uncertain food inflation outlook… Based on the RBI’s assessment of inflation and its new interpretation of the policy stance, any rate cut before the August 2024 policy looks unlikely. By August, we will have a fair understanding of the monsoon progress and sowing trends to make a reasonable assessment of the food inflation in FY25.

There was an expectation that the RBI would announce some liquidity infusion measures to deal with the recent tightness in the banking system. However, the RBI seems comfortable with the overall liquidity condition and doesn’t see any need to infuse durable liquidity at this stage.

The only issue with the RBI’s liquidity assessment is that the government has been maintaining high cash balances on a persistent basis. In the 10 months of FY24, the government cash balance has averaged above Rs. 2 trillion. Extrapolating this trend into the future implies that banking system liquidity will continue to be in deficit.

Moreover, cash withdrawals tend to pick up between the February to May period. Based on historical trends, around Rs. 2 trillion might be withdrawn from the banking system over the next four months adding further to the liquidity deficit. Thus, we expect liquidity condition to tighten significantly over the coming months.

We expect short-term money market rates to remain elevated due to the tight liquidity environment. This should be supportive for liquid funds that rely on interest accruals on short-term debt instruments. For the bond market, the outlook remains positive supported by the falling inflation trend, the possibility of rate cuts, global bond index inclusion and favourable demand-supply mix.

Investors with a 2-3 years investment horizon can consider dynamic bond funds to potentially benefit from the falling bond yields. Conservative investors with shorter holding periods should stick with liquid funds.

Kotak Alternate Asset Managers Limited CEO-Investment & Strategy Lakshmi Iyer said, “Status quo in rates and stance in line with our and market expectations. No major worries expressed on the inflation front is comforting, but for food price fluctuations – the watch for global cues however continues. While the FY 25 inflation forecast is at 4.5%, as per RBI the last mile walk is very crucial, hence the walk towards headline CPI of 4% is key for RBI.

“Liquidity lifeline from RBI to the banking system may continue as Q4 tends to be tight one due to advance tax outflows, as also the impending general elections, which could also see the currency in circulation going up. We expect bond yields to trade in a tight range tracking US bond yields. Foreign buying of govt bonds is likely to keep buoyancy in bond yields intact, despite near-term upticks if any. Investors may look to add duration to ones fixed income portfolio on price dips.”

State Bank of India Chairman Dinesh Khara said, “The MPC decision to hold rates and stance was expected but the set of regulatory decisions holds out a pragmatic and steadfast approach in the quest for digital robustness, customer centricity and price discovery. The decision to have a key fact statement regarding retail and MSME advances will empower customers to make informed decisions. Enhancing the robustness of AePS, authentication of digital transactions through new mechanisms and operational changes in CBDC are all important milestones of systemic resilience and a better future.”

Essar Capital Ltd Senior Managing Director Sanjay Palve said, “By keeping the repo rate unchanged, RBI exhibits dedication to creating a favourable environment for investment and ensuring stability in the financial markets. This decision signifies the RBI's commitment to fostering economic growth while managing inflation risks, which is crucial for maintaining a healthy financial landscape in India.”

Commenting on RBI’s approach, IndiaFirst Life Insurance Company Chief Investment Officer Dr. Poonam Tandon said, “Overall, the commentary was balanced with adequate focus on inflation while maintaining the growth outlook. We believe the RBI has enough space for holding rates at current levels and may not cut rates in at least the first half of FY25.”

Umesh Revankar, Executive Vice Chairman, Shriram Finance said, “The RBI has once again stressed that the lending ecosystem needs to become more customer-centric while emphasizing the broader vision of financial inclusion. Despite global challenges, the Indian economy has been resilient, with rural demand gaining momentum and urban consumption remaining robust. The economy is adapting well and exhibiting positive growth indicators. There is so much to look forward to as we step into what could be a transformative year for India and the world.”

Shriram Life Insurance Chief Investement Officer Ajit Banerjee said, “The tone of the MPC was fairly balanced, with adequate focus on reaching the inflation target with a reasonable degree of comfort on GDP growth. RBI expects FY25’s real GDP growth to be at 7%. The RBI continues to expect average headline CPI inflation at 5.4% in FY24. The RBI didn’t appear to be overly concerned about the liquidity situation while assuring that it stands ready to use enduring and frictional liquidity management tools to anchor the money market rates around the repo rate. Therefore, we expect the RBI to continue to focus on fine-tuning of liquidity conditions through VRR/VRRR auctions to gradually align the overnight rates with the repo rate."

On today’s RBI Monetary Policy, Essar Ports MD & CEO Rajiv Agarwal, “The RBI's decision to maintain the repo rate at 6.5% signals stability amidst global slowdown. Increased liquidity due to reduced govt borrowing will bring down rates. it also reflects support for economic growth and financial stability. With inflation expected to ease in 2024, the RBI's cautious approach aims to strike a balance between containing inflation and fostering economic momentum.”

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.