Industry hails RBI's decision to keep key policy rate unchanged, continue withdrawal of accommodative stance

Mumbai: The Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) on Friday announced it will maintain the repo rate at 6.5 percent for the fourth consecutive time.

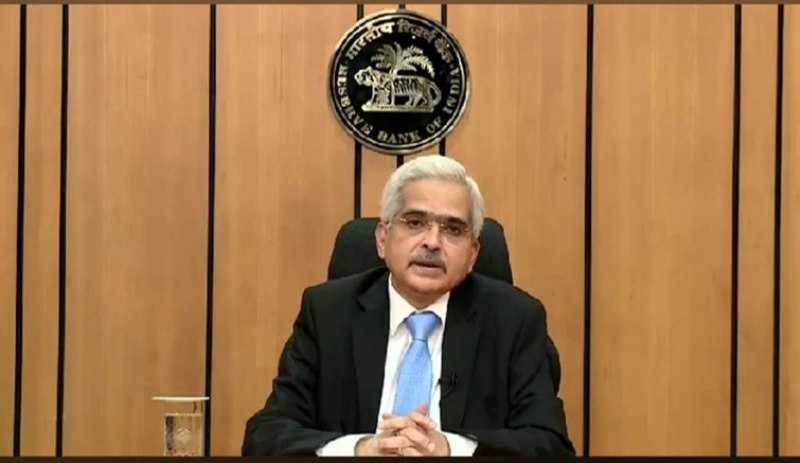

RBI Governor Shaktikanta Das, while revealing the MPC's decision, stated that it was a unanimous decision. He further noted that with a majority of 5:1, the MPC opted to persist with the process of withdrawing accommodation.

Reacting to RBI’s decision to keep the repo rate unchanged, Essar Ports MD & CEO Rajiv Agarwal said RBI’s Monetary Policy rightly focuses on India's commitment to macroeconomic stability and fundamental growth. “The decision to maintain the repo rate unchanged at 6.5% for the fourth consecutive time reflects RBI's prudent approach in sustaining economic equilibrium, while the 5.4% inflation outlook underscores its dedication to price stability. This will help capital spending and investments to flow in the Ports & infrastructure sector and contribute to the India growth story.”

RBL Bank Economist Achala Jethmalani said MPC’s decision is “in line with our expectations.”

“The MPC maintained a status-quo on policy rates and stance. We view it as a ‘hawkish hold’ on policy rates as the focus remains on bringing inflation down to the 4.0% target.

“The RBI’s comments on existing banking system liquidity is indicative of tighter system liquidity conditions continuing as it stands ready to deploy all its tools to absorb excess system liquidity. Brace for a long pause on the Repo Rate with tighter liquidity conditions.

“This is expected to complete the policy transmission in this hiking cycle with the objective of keeping borrowing costs high. The resilience in economic growth despite the restrictive financial conditions underpin the RBI’s move to tighten the liquidity conditions.”

Essar Capital Ltd. Senior MD Sanjay Palve said the MPC’s decision to keep the repo rate unchanged at 6.50% and maintain a ‘withdrawal of accommodation' stance, demonstrates a responsible approach to monetary policy and aligns with industry expectations in the current dynamic economic scenario.

“This constancy offers businesses a clear and stable monetary environment during a period of fiscal challenges and uncertainties. It's essential for boosting investor confidence and facilitating long-term strategic planning. This choice conveys a strong message of resilience and stability as we navigate the complex economic environment, supporting India's continuous efforts toward sustainable growth.”

Bandhan Bank Chief Economist and Head of Research Siddhartha Sanyal said, “The status quo on policy rates in October is no surprise; the move was supported by all the six MPC members, as expected. After a sharp spike in the first half of the last quarter, prices of agro commodities softened during the latter half of the quarter offering the central bank some breathing space at this juncture.

“Such softening in agro prices will likely lead to sub-6% CPI inflation rate in the coming months. This, coupled with negative WPI prints and uneven pace of recovery in various sectors in the economy, will likely prompt the MPC to demonstrate patience and maintain status quo on key policy rates in the coming months.

“However, the MPC looks set to stay cautious given rising risks in the global macro backdrop and possibility of further hikes by global central banks (eg., the US Fed) later this year. The RBI’s reiteration of their commitment to the CPI target of 4% further underscores this point as rates look set to stay higher for longer.”

ICRA Analytics Head- Market Data Ashwini Kumar said, "The Reserve Bank of India has maintained the status quo on policy rates at the just concluded Monetary Policy Committee meeting as inflation persists above the targeted rate, uneven rainfall is likely to affect agri supply ahead of the onset of festive season.

“Globally, the US Fed persists with its hawkish stance even as oil prices have retreated.

“The 10-year government bond yield is likely to rise as the central bank has said it will consider Open Market Operations (OMO) sales to manage liquidity in the system. ICRA Analytics foresees the 10Y benchmark yield to trade between 7.25- 7.40% in the near term."

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.