Indian govt denies plans to levy GST on UPI transactions above ₹2,000

New Delhi: The government on Friday firmly denied reports suggesting it plans to impose Goods and Services Tax (GST) on Unified Payments Interface (UPI) transactions exceeding ₹2,000, describing such claims as “false, misleading, and baseless.”

“There is no such proposal under consideration,” the government clarified in an official press statement.

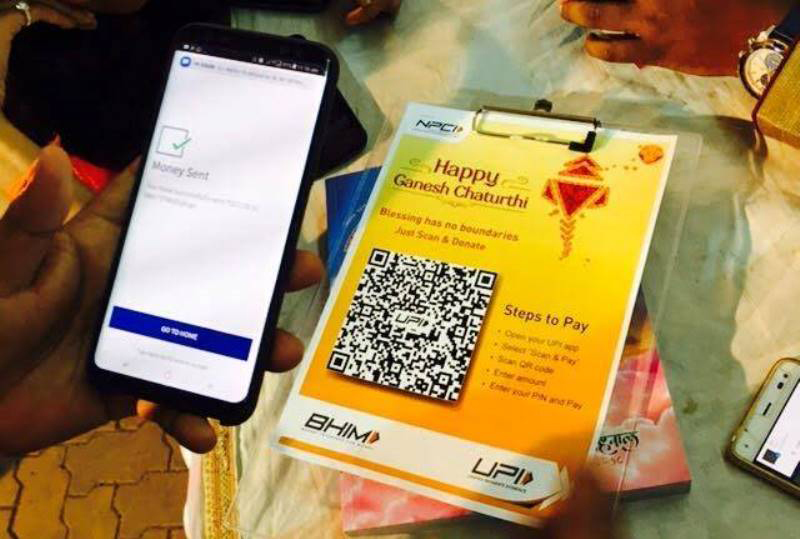

Currently, UPI payments made to merchants do not carry any additional charges like GST. This is because the Merchant Discount Rate (MDR) — a standard fee on digital transactions — was scrapped for UPI and RuPay transactions back in January 2020. Since there's no MDR being applied, the question of GST does not arise.

Reinforcing its stance, the government pointed to its active promotion of UPI-based digital payments, particularly through a special incentive scheme introduced in 2021.

This scheme reimburses service providers to offset transaction costs, making it easier for small merchants and businesses to accept UPI payments.

Disbursements under the scheme highlight the government’s commitment: ₹1,389 crore in 2021-22, ₹2,210 crore in 2022-23, and ₹631 crore in 2023-24.

India leads in global digital transaction volume

These measures, the government noted, have significantly accelerated the adoption of digital payments in India. Citing data from ACI Worldwide, it said India accounted for 49% of all real-time digital transactions worldwide in 2023.

Over the past five years, UPI transactions have grown more than twelvefold — from ₹21.3 lakh crore in 2019-20 to over ₹260 lakh crore by March 2025. Of this, merchant payments alone contributed ₹59.3 lakh crore, underscoring the rising trust and usage of digital payments among both sellers and consum

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.