Disinvestment

Disinvestment

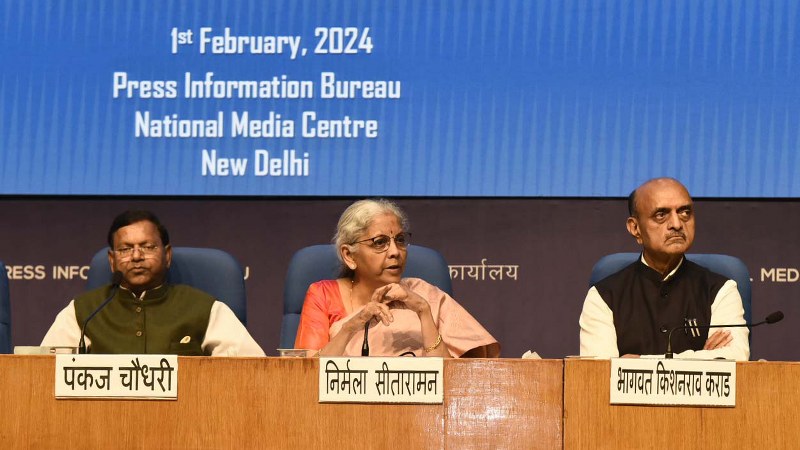

Govt open to divesting stake in SBI, ONGC: Nirmala Sitharaman

New Delhi: Finance Minister Nirmala Sitharaman on Friday stated that the government is open to the concept of disinvesting equity stakes in prominent Public Sector Undertakings (PSUs), including the likes of State Bank of India (SBI) and Oil and Natural Gas Corp (ONGC).

In an exclusive interview with Network18, she clarified that the government does not oppose the idea of maintaining a minority stake, which is less than 50 percent, in crucial strategic public sector enterprises.

“Absolutely,” Sitharaman told Network18 Editor-in-Chief Rahul Joshi when asked if she was okay with holding 49 percent or less in PSUs including SBI and ONGC.

Currently, the government holds a controlling 57.49 percent stake in SBI and a 58.89 percent stake in ONGC.

“You will see periodically, DIPAM, the department which takes care of the disinvestment has slowly released a lot of government's shares into the market so that private ownerships can come in and they can take hold of those shares,” said Sitharaman.

In recent years, the government has actively pursued divestment, divesting stakes in various publicly listed and privately held companies. Nevertheless, the only instance of selling a controlling stake in recent years was in Air India, which was acquired by the Tata Group.

The finance minister underscored the government's commitment to initiatives that improve the valuation of Public Sector Undertakings (PSUs). Traditionally, government-owned companies have traded at discounts compared to their private counterparts. However, in the last couple of years, there has been a narrowing of this valuation gap.

“We are working to make sure that…the valuations are kept up,” she said. “If you look at the public sector listed companies and their valuation in the market today, you see the kind of vibrancy which has been brought into them. The share prices have gone up, the dividends are much better than earlier. So, disinvestment is one thing but (we are working on) bringing value to them, and making sure that the market looks at them favourably.”

Sitharaman underscored that the private sector has been granted entry into "core strategic" sectors, and the government's objective is to maintain only a "minimum presence" in these sectors.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.