Budget 2024-25: Tax reliefs, infrastructure growth, and EV push top expectations

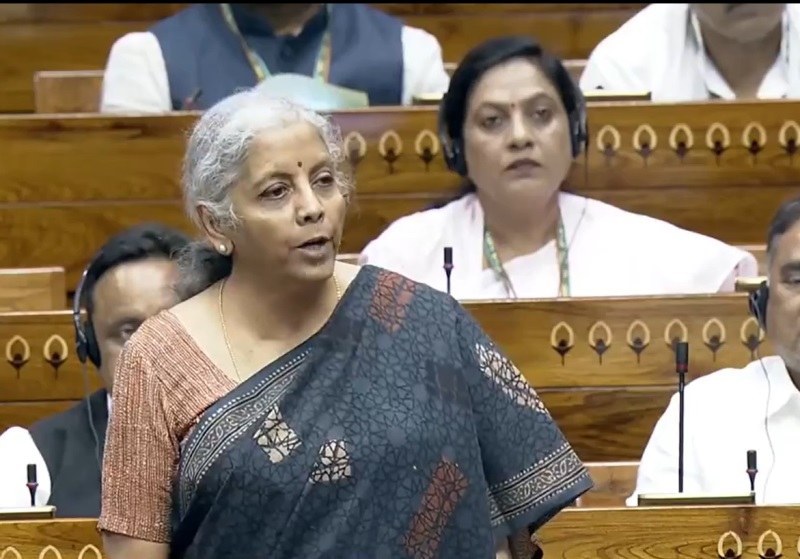

New Delhi: Finance Minister Nirmala Sitharaman is all set to present the full Union Budget for the Financial Year 2024-25 on Tuesday July 23. There are a multitude of expectations from the Budget, the first from the newly elected Narendra Modi government. Many experts are of the opinion that the Modi government will lean towards a populist budget in its third term This is also driven by the fact that, lacking an absolute majority, the Bharatiya Janata Party needs to keep its coalition partners on board.

Taxpayers are hoping for substantial tax reliefs—such as increased standard deduction limits and adjustments to the income tax brackets. Taxpayers want Budget 2024 to implement measures that will alleviate their financial strain.

The industry, on the other hand, is looking forward to a growth-oriented budget that continues to drive infrastructure development and boosts manufacturing. They anticipate policies that will help India surpass the target of a USD 30 trillion GDP, aligning with the goal of achieving 'Viksit Bharat' by 2047.

Lord’s Automative CEO Veer Singh said the budget is expected to lay a strong foundation for achieving the government’s green mobility goal i.e. to facilitate EVs to attain 30 percent of the total car sales by 2030.

The growing awareness and increasing availability have triggered EV adoption in India both in metros and tier 2 and tier 3 cities. The budget should propose measures to make EVs accessible and affordable to the larger population of the country, he said.

Apart from allocating capex for developing charging infrastructure, battery recycling facilities, etc. to strengthen consumer confidence, the budget should propose subsidies and incentives in the form of tax benefits to facilitate large-scale EV adoption for private and commercial use. An effective approach to make sustainable mobility accessible to all is to promote localised manufacturing. Therefore, we expect the budget to announce supportive measures to achieve self-reliance in EV manufacturing and EV supply chain. In addition, the budget needs to adopt a futuristic approach and propose measures to make India a global hub for EV manufacturing.''

Senco Gold MD & CEO Suvankar Sen said, “The gold price has moved towards all time, and it is supposed to increase the price more, for global uncertainties leading to difficulty in customers to buy domestically and globally.”

To increase employment amongst Karigars, growth in export demand, and make the gold asset affordable to Middle class, our request to reduce duty, help with emi for hallmarked Jewellery with proper tracking and support in export promotion schemes.

Photo courtesy: Pixabay

Photo courtesy: Pixabay

ElectricPe Co-Founder & CEO Avinash Sharma, "Given the theme of continuity in the new government, we are optimistic that this will extend to EV policy as well. Over the past year, we've witnessed significant growth in EV sales and production, driven by favourable government policies and increased sector confidence. With the union budget just days away, we hope for streamlined subsidies and incentives at both state and central levels - a consistent 5% GST rate on charging infrastructure across states will be crucial for accelerating EV adoption and expanding infrastructure. Additionally, we eagerly anticipate the announcement of FAME 3 and the government's plans for developing Electric Vehicle Ready Highways in this upcoming budget."

Volvo Car India Managing Director Jyoti Malhotra, “Given the increasing demand in the mobility sector the Union Budget will hopefully set a road map for a faster adoption of EVs both for personal and commercial transportations. Indian economy has been moving towards new and sustainable technology products and we anticipate that the budget will outline a policy framework for sustainable development. Volvo Cars will provide the required sustainable impetus to the personal mobility sector through our global best technology offerings for the Indian market. As such we anticipate that the budget will encourage introduction of advanced sustainable technologies most suited to the fast growing Indian market.”

Managing Director of Lord's Mark Industries Sachidanand Upadhyay, “'The healthcare and pharmaceutical industries are poised for robust growth due to heightened awareness of preventive wellness, continuing infrastructure development and policy support, rising healthcare demand and technology interventions. Therefore, the budget should create an enabling framework with favourable policy support to boost innovation, market accessibility and affordability. India becoming self-reliant in healthcare delivery and India emerging as a global pharma powerhouse will further accelerate our economic growth and help us climb the global value chain.

“We expect the government to increase the health budget to boost infrastructure development to include more and more people under healthcare coverage. The budget also needs to propose measures to boost public-private partnership to ensure better healthcare outcomes in the country. In addition, the government needs to announce measures to incentivise R&D to facilitate an effective value chain integration. The pharma sector also seeks favourable support in terms of a board-based production linked incentive (PLI) scheme to build export competitiveness.''

Group CFO of CarDekho Group Neelesh Talathi said further support to innovation and competitiveness in the auto industry tops his expectations.

"Key focus areas include facilitating the creation of EV charging infrastructure, offering tax rebates on EV leasing, and mandating electrical vehicle procurement for government use. Further, the industry looks forward to initiatives that will boost R&D investments, particularly in advanced technologies like AI, batteries, and connected infrastructure. We have witnessed significant contributions by Auto-tech startups and encourage the government to remove the 'Angel Tax' and address dual taxation on ESOPs.

"We hope that this Union Budget 2024 clears all roadblocks and provides rocket fuel to accelerate our leap towards Viksit Bharat."

Aparna Constructions Managing Director of Rakesh Reddy, “The upcoming Union Budget 2024-25 presents a crucial opportunity for the Indian real estate sector to introduce essential policy reforms aimed at driving growth and fostering development, particularly within the affordable and luxury housing segments.

“Ample policy support is essential to bolster demand and enhance overall affordability. Furthermore, key expectations such as gaining infrastructure status, streamlined approval processes, improved access to funding, and rationalization of GST must be addressed. It is imperative to implement policies that increase tax benefits for housing loans, reduce long-term capital gains tax on real estate investments, and extend the reach of affordable housing initiatives.

“Rationalising GST to reduce expenses and easing FDI regulations to attract foreign capital are essential steps to improve accessibility and boost growth in the luxury segment. With the real estate sector contributing 8% to India's GDP, stakeholders are eagerly awaiting policy changes that would foster increased investments from both domestic and international sources.”

Photo courtesy: Pixabay

Photo courtesy: Pixabay

The real estate industry is currently exploring strategies to promote greater accessibility to homeownership for a broader segment of the population, while also supporting the interests of developers. We are proposing an increase in the ceiling on home loan interest deductions to incentivise potential homebuyers. The proposal to raise the limit from ₹2 lakh to ₹5 lakh is projected to have a positive impact on middle-income buyers and drive demand within the market. Furthermore, efforts are being made to reassess affordability housing limits under the Pradhan Mantri Awas Yojana (PMAY) to more accurately align with the varying market dynamics observed across different cities.”

According to Unimon Travel and Holidays Ltd subsidiary of Unimoni Financial Services on the travel and tourism sector, “We anticipate that the budget will include additional strategic measures that build on the announcements made in the Interim Budget on airport development, long-term, interest-free loans to states for the construction of iconic tourist destinations, and initiatives to improve the infrastructure for tourism on our islands.

“Improving infrastructure, including highways, airports, and popular tourist spots, is essential to drawing in both domestic and foreign tourists. The upcoming budget offers a critical chance to maintain India's standing as a major global tourism destination while promoting equitable development throughout the country.”

Photo courtesy: Unplash

Photo courtesy: Unplash

Founder & CEO, Motovolt Mobility Tushar Choudhary said the EV sector expects an expansion of the FAME II scheme with increased subsidies, especially for commercial EV fleets including 2 Wheelers.

It is crucial to incentivize domestic manufacturing of EV components like batteries and electronics to reduce import dependency and bolster supply chains.

Lowering GST on EVs and components would boost affordability, while enhanced tax benefits for EV buyers and infrastructure investors will spur adaptation to the sector.

Allocating funds for Charging Stations in Urban, Highways, and Rural Areas is essential for Infrastructure Development alongside incentives for Battery Swapping Stations.

Investments in R&D for Updating Battery Technology, EV Powertrains, and Charging Infrastructure are critical, as is enabling industry-academia collaboration for innovation. Strengthening State and Central EV policies, coupled with robust Vehicle Scrappage Policies, will help facilitate the adoption of EV Vehicles and form the shift from ICE vehicles.

Green financing, low-interest loans, and public awareness campaigns about the EV benefits will provide the boost needed by the industry.

Integrating EV charging with renewable energy and supporting energy storage solutions will advance clean energy use, aligning with sustainability goals. We look forward to a budget that addresses these priorities, laying the groundwork for a resilient and sustainable EV ecosystem in India, reducing carbon emissions and promoting eco-friendly mobility.

HDFC securities Head of Retail Research Deepak Jasani The forthcoming Union Budget due in July 2024 could continue the roadmap laid out in the previous Budgets barring a small course correction. It could largely retain the revenue and expenses projections made in the interim Budget (except for the windfall dividend from RBI).

This additional receipt from the RBI could be used to i) cut the fiscal deficit target to 5.0% for FY25 from 5.1% in the interim Budget thus reinforcing the inclination to stick to fiscal consolidation; ii) make higher transfers to states for capex spend iii) increase transfer under PM KISAN from Rs.6000 p.a. to Rs.7500 p.a. iv) provide incentive to income tax payers to shift to the new tax regime by providing higher standard and other deductions/higher exemption limit/changes in tax slabs.

While there exists a fear among investors about the probability of the Govt turning populist in the Budget post the recent poll outcome, we feel that the recent announcements of ministerial appointments and modest MSP hikes negates such a fear. The Govt is likely to shun the race of competitive populism through handouts and is not likely to abandon the path of fiscal prudence although it may make extra efforts to win over a larger population of rural and urban poor by incurring targeted social welfare spends. It may want to protect its image of being a responsible, clean Govt, cutting wasteful spending, eradicating corruption, bringing more transparency by reducing off-Budget items and maintaining fiscal prudence.

The Budget could bring benefits to several sectors, including affordable housing, Industrials/Engineering, Consumer goods etc. The NDA 3.0 has already announced the decision to help 3 crore additional rural and urban households for the construction of houses.

The Union Budget could see the government paving the way for foreign-domiciled Indian startups to flip their corporate headquarters back to India — via the special economic zone of GIFT City — with minimal tax implications and to woo other companies to the Gift city with tax-breaks and other sops.

MSME sector could receive special mention by way of measures to ease capital raising and relaxing norms in NPA recognition by Banks. Banks could get a leg up in deposit mobilisation by way of enhanced deduction for interest receipts by depositors. Agri revival could be a major thrust in the Budget and provisions may be made for rationalisation of GST rates on certain agricultural inputs; and enhanced capex may be considered for deployment in rural infrastructure such as irrigation, warehousing and cold chains.

Steps to discourage F&O trading by retail investors could also be announced in the Budget or ahead of it. The Govt may announce its intent to divest some stake in low float PSU stocks as they are seeing valuation bubble although the divestment target may not be hiked majorly.

An Employment Linked Incentive scheme for labor intensive sectors like toys, textiles, furniture, tourism, logistics, small retail and media & entertainment may also be announced.

Measures to bring down the interest rates in the system could trigger higher business activity, new capex announcements, reduce the interest outgo for businesses and expand valuation of stocks. For this, sticking to the fiscal consolidation path and desisting the tendency to turn populist will be appreciated.

Higher focus on capex (vs higher revenue expenses) in the Budget will send a good signal to the markets and investors – both local and global.

India's current capital gains tax structure is complex, with multiple rates depending on the type of capital asset and the holding period. There is a need to simplify this. However, in case this results in higher tax outgo or longer holding period on listed securities, the markets may react adversely in the short term.

As some fears on this count are getting discounted, the markets may react positively to status quo on this. We don’t think that there would be any major changes to the capital gains tax although we do not rule out higher tax burden in some form on the urban rich.

STT on HFT trades need to be raised so that the retail traders who are losers in most F&O trades are protected to some extent. However, this may impact the volumes and depth in the market and adversely affect the revenues of the exchanges/SEBI. To discourage the galloping trades in options, income from F&O trades may be treated as speculative income and not normal business income.

Current taxation on dividends in the hands of shareholders is viewed as double taxation since the company already pays taxes on its profits. Any relief from this double taxation on dividends would be appreciated.

Any measure to encourage flow of money to equity markets (directly or through MFs) will be appreciated.

We do not expect any sizeable correction in the markets before the Budget and the correction post that may be short lived unless impacted by some other trigger.

However, retail investors will do well to review their asset allocation and equity portfolio and rebalance their excess holdings in equities (due to the rise in values) into other asset classes and in the process take some profits out of stocks that have run up much ahead of their fundamentals in the past few months.

InfoVision Senior VP - Finance Uma Shankar Patro said his company is awaiting transformative policies that bolster India's digital economy. As a key player in the IT sector, we look forward to initiatives that foster innovation, strengthen digital infrastructure, and promote skill development.

“We expect the budget to prioritize investments in emerging technologies like AI/ML, Data analytics, 5G, Telemedicine, and cybersecurity, ensuring India's global competitiveness. Additionally, measures for startups and SMEs in the IT sector will be crucial for fostering entrepreneurship and job creation. Embracing innovation, inclusivity, and sustainability, the upcoming budget can propel India towards becoming a global leader in the digital age.”

We hope that the budget will include measures to create buffer stocks of essential food grains like rice and wheat to address any shortfall in production and also to avoid export restrictions.

Strengthening access to credit for long-term loans is essential to enhance growth, productivity, and farm income in the agri- commodity sector. Additionally, minimizing wastage by augmenting storage capacities and upgrading warehouses is crucial. Infrastructure still continues to be a challenge and its pan-India development is a critical driver of agricultural growth. Building rural infrastructure, including roads, bridges, storage facilities, cold chains, and veterinary services, can significantly reduce post-harvest losses and improve market access for farmers in remote areas. These measures will lead to increased participation of India in global agriculture and food exports.

We recommend enhancing the budget allocation for the Agricultural and Processed Food Products Export Development Authority (APEDA) to boost farm exports. Establishing district export hubs are essential steps toward achieving these goals.

These initiatives are critical for the sustained growth and global competitiveness of the rice industry, and we look forward to positive steps in this direction in the upcoming budget.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.