Budget Reaction

Budget Reaction

Budget 2023-24: EV sector welcomes custom duty reduction on capital goods for Lithium batteries manufacturing

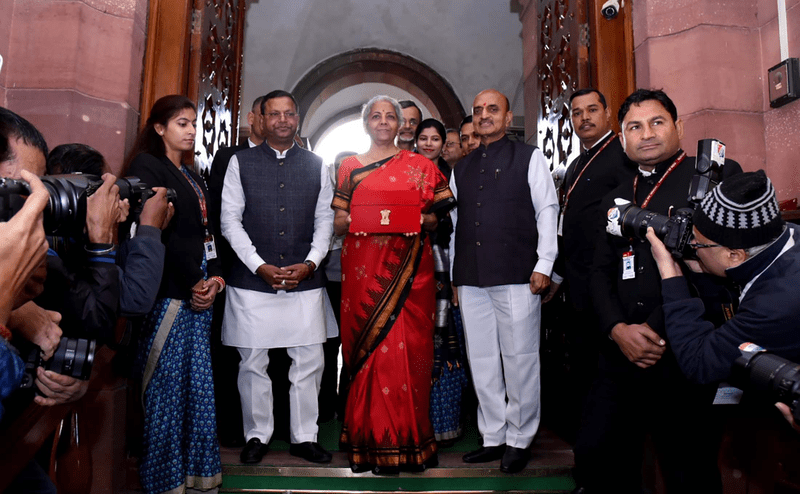

New Delhi/IBNS: The electric vehicle industry welcomed the reduction in customs duty on lithium cells and subsidy extension on batteries announced in the Union Budget 2023-24 by Finance Minister Nirmala Sitharaman on Wednesday.

CEO of Consumer Business, CarTrade Tech Ltd. Banwari Lal Sharma said the Union Budget 2023-2024 is a 'green budget' for the automotive and mobility sectors.

The sustainability measures taken through announcements on green hydrogen and other energy sectors will help in furthering the government’s target of carbon neutrality by 2070.

The increased Capex outlay on energy transition is likely to spur investments and skill development in a green economy.

The viability gap funding for battery energy storage systems is also likely to create critical infrastructure, while custom duty reduction on capital goods for Lithium batteries manufacturing will facilitate faster adoption of EVs.

An increase in spending on infrastructure, setting up of 50 new airports and heliports, creation of 100 transport infrastructure projects are welcome moves, in addition to the central support for replacing old vehicles. All of these should drive consumption and overall demand of vehicles, he added.

Log9 Materials Co-Founder & Director Pankaj Sharma said the proposed Customs duty exemptions on the import of capital goods and machinery required for the manufacturing of lithium-ion batteries bring in a new lease of life for all battery manufacturers.

This would help accelerate the country’s production capacity and also gives much-needed momentum to the country’s vision to become self-sufficient in its EV needs.

Chairman & Managing Director, Wardwizard Innovations & Mobility Ltd Yatin Gupte said the sanctioning of Rs 35,000 crores for energy transition is a significant step toward India's net zero goals and will undoubtedly provide a much-needed push to a sustainable tomorrow.

Tax exemptions on capital goods, lithium-ion batteries, and further reduction of customs duty will accelerate green mobility and rapid transition towards electric vehicles, making the sector stronger than before.

“We are eagerly looking forward to the government’s ambitious vision for upgrading the EV infrastructure ecosystem. Further relaxation on personal taxes and push for job creation will bring sustainability in the market and increase purchasing power,” he stated.

Domestic consumption is a prime driving force for the economy, he said. “With the infrastructure boost and effective capital expenditure, the industry is optimistic that this budget will definitely augur well for the economic recovery and overall growth of the country."

Co-Founder Neuron Energy Pratik Kamdar the Government’s fidelity to reducing carbon footprint in the country has been re-assuring in the Union Budget 2023. The push towards green mobility will propel the growth of the EV sector in India and will encourage further investments.

With its focus on green growth and push for green mobility, this budget provides the much-needed impetus to the sector.

The Customs Duty exemption on capital goods and machinery to manufacture li-ion will be a facilitator for the country to transition to sustainable and eco-friendly mobility.

The exemption will have a domino effect on the overall sector with the over substantial decrease in the overall cost of the finished products wherein the battery packs are likely to reduce by 5% coupled with lower initial investments.

Additionally, the vehicle scrapping policy will also be beneficial if the old vehicles are replaced by electric vehicles. This will further aid in the country’s vision of mass EV adoption by 2030.

The sector also holds immense potential with regard to providing entrepreneurship opportunities and job creation. With decreased capital investments to manufacture ancillary supplies like li-ion batteries, it will provide a platform for new-age businesses and entrepreneurs to venture into the space.

Overall, we are confident that this Budget will aid in the country’s adoption of electric mobility significantly.

Mitsubishi Electric India Pvt. Ltd Chief Strategy Officer Rajeev Sharma said the budget 2023 is oriented to the economic growth of the country.

He said 33% growth in capital expenditure will result in balanced development and a smart move as it will push the country on the track to becoming a 5 trillion-dollar economy and a global powerhouse.

I believe that the announcement of setting up 100 labs to effectively develop 5G services and the vision to promote Artificial Intelligence in overall industries is a strong step by the government.

This will further lead to automation in the industries which will help in propelling India’s growth and promoting smart cities.

Reacting to the Budget, Bridgestone India MD Stefano Sanchini said the increase in capital expenditure outlay by 33% will directly impact the logistics and mobility sectors.

These sectors would also grow as they expand to serve the enhanced demand for goods generated by new infrastructure projects.

The Finance Minister’s statement on replacing old government vehicles will increase the demand for new vehicles and we are committed to supporting the OEMs meet this demand, he added.

Vinod Aggarwal, President, SIAM and MD & CEO, VECV said a 33 % increase in capital outlay with an effective provision of Rs 13.7 lakh crores will spur growth in the economy resulting in a positive impact on the Auto sector.”

Adding further, he stated, “The Auto industry is fully aligned with the initiatives on Sustainability and Decarbonisation and increased focus on Hydrogen, Ethanol Blending, Bio Gas, Electric Vehicles and Battery Storage."

An announcement for funding various Government Departments for the replacement of old vehicles is also commended.

Another appreciable feature of the budget is putting more money in the hands of individuals by some lowering of effective personal income tax rates that should increase consumption and consequently lead to more demand.

All in all, this is a growth-oriented budget with a positive impact on the Auto Sector, he added.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.