Budget 2017: Anti-graft and rationalisation measures announced in the field of income tax

He said that the Government is trying to bring within tax-net more people who are evading taxes.

In this direction, the Finance Minister has reduced the Income Tax rate from 10 to 5 per cent for small taxpayers.

Besides , the Finance Minister announced various rationalization measures in the General Budget 2017-18, some of which are listed below-

(i) The Budget proposed that if an accountant or a merchant banker or a registered valuer, furnishes incorrect information in a report or certificate, he shall be liable to a penalty of Rs 10,000 for each such default.

(ii) To promote green growth, the Finance Minister has proposed to provide a concessional tax rate of 10 per cent in case of income arising from sale of carbon credit.

(iii) In line with exemption available to the Prime Minister’s Relief Fund, now the income of the Chief Minister’s Relief Fund or the Lieutenant Governor’s Relief Fund shall be exempt from tax.

(iv) To boost the growth of call center industry and increase employment opportunities for the Indian youth, the Finance Minister proposed to lower the rate of deduction of tax in case of payments made to a person engaged only in the business of operation of call centre.

(v) It is proposed to provide for grant of interest in case of refund of excess payment of TDS. At the same time, to ensure timely filing of returns of income, a fee will be levied in case of delay in filing the return.

(vi) It is proposed to authorise the Central Board of Direct Taxes (CBDT), to issue directions or instructions in order to remove hardships faced by the taxpayers in connection with imposition of penalty relating to tax deduction or collection at source.

(vii) The Budget also clarifies that provisions relating to tax deduction at source shall not apply to exempt compensation received under the Right to Fair Compensation and Transparency in Land Acquisition, Rehabilitation and Resettlement Act, 2013.

(viii) In order to strengthen the TCS regime, it is proposed to provide that the collectee shall furnish his PAN to the collector, failing which, tax shall be collected at a higher rate.

(ix) It is proposed to provide that no person shall receive payment or aggregate of payments of an amount of Rs 3 lakh or more from a person in a day, or in respect of a single transaction, or in respect of transactions relating to one event or occasion, otherwise than by an account payee cheque or account payee bank draft or use of electronic clearing system through a bank account. This restriction shall not apply to Government, banks or certain other categories as notified by the Central Government. Contravention of this provision will invite penalty.

(x) In order to remove hardship, it is proposed to omit section 197(C) of the Finance Act, 2016 which provided for assessment of undisclosed income relating to any period prior to commencement of the Income Declaration Scheme, 2016. However, in search cases, it is proposed to provide that in case tangible evidence is found during the search, the Assessing Officer can assess income upto ten years preceding the year in which search took place

(xi) It is proposed to merge the Authority for Advance Ruling (AAR) for Income-Tax with AAR for Customs, Central Excise and Service Tax; and create common AAR. It is proposed to make the orders passed by the authority under section 10(23C) of the Income-tax Act, appealable before the Tribunal.

(xii) To provide parity between an individual who is an employee and an individual who is self-employed, it is proposed to provide that the self-employed individual shall be eligible for deduction upto 20 per cent of his gross total income in respect of contribution made to National Pension System Trust.

(xiii) It is proposed to provide tax neutrality in case of conversion of preference shares of a company into equity shares of that company.

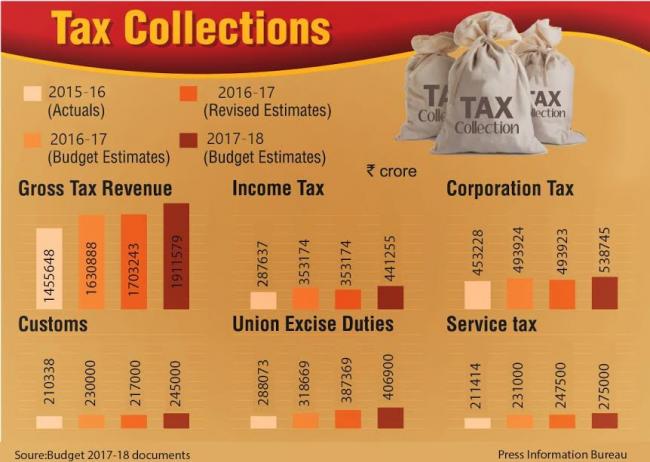

Image: FinMinIndia Twitter

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.