BSE PSU Index outperforms Nifty 50 over past 5 years, analysis shows

Mumbai: The trend over the last five years show that the BSE PSU Index has demonstrated an impressive annualized return of 28%, nearly doubling that of the Nifty 50, according to DSP Mutual Fund Annual Note 2024.

This surge in performance continued even in the past year, with the PSU index soaring by 60%, while the Nifty 50 recorded a comparatively modest increase of 20%.

According to analysts, conventional wisdom attributes this robust performance to governmental support and reduced interference. However, a recent analysis conducted by DSP reveals a deeper insight. According to the analysis, the key driving force behind this surge is the notable expansion in return on equity (ROE) and operating metrics of Public Sector Undertakings (PSUs), leading to a significant rerating of these entities.

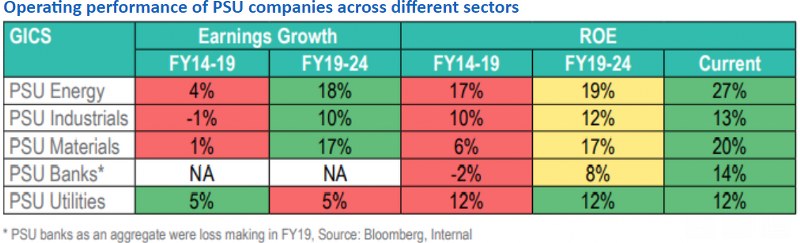

Specifically, PSU energy companies have experienced substantial profit growth, recording a Compound Annual Growth Rate (CAGR) of 18% over the period from FY19 to FY24, in stark contrast to the mere 4% growth witnessed in the preceding five years.

This turnaround story is not limited to the energy sector alone. Similar positive shifts have been observed across various PSU verticals, including industrials, materials, and banks.

One of the key indicators of this transformation is the ROE, which now surpasses the cost of capital in many instances, consequently propelling valuations higher and attracting investor interest.

The findings from DSP's analysis shed light on the underlying factors contributing to the impressive performance of PSU stocks, offering valuable insights for investors and market observers alike.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.