7 Reasons to Start Financial Planning Early

Most of the people consider financial planning as an old man’s game. However, a rupee invested today would be more than a rupee invested tomorrow, and therefore, the sooner the one starts investing, the greater the benefits are available. It’s never too early to start a financial planning.

Here, are some of the reasons to start your financial planning early=

1. Power of Compounding= In compounding, any interest you earn is reinvested with the principal amount, and the aggregate corpus fetches high interest. Moreover, when you are young, time is on your side, and you can easily start your investmentwith a small amount of money.

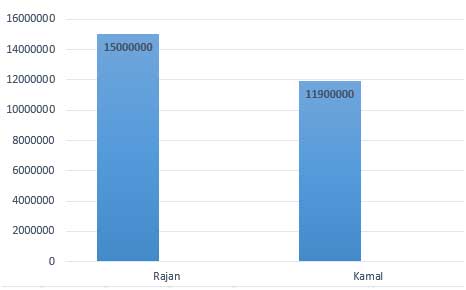

Compounding works magic if the time horizon of investment is long, as it is evident from the following-

| Parameters | Rajan | Kamal |

| Current Age | 30 years | 40 years |

| Retirement Age | 60 years | 60 years |

| Monthly Income | Rs 50,000 | Rs 50,000 |

| Regular monthly investments | Rs 10,000 | Rs 20,000 |

| Assuming Interest Rate | 8% | 8% |

| Compounding Interval | Annually | Annually |

| Total Corpus at 60 years | Rs 1.50 crore | Rs 1.19 crore |

2. Ahead of others= The early bird gets the worm is an idiom worth obeying to. The earlier you start investing, the better your financial life would be. In comparison to thosewho have delayed their investment, you will be in a better state to afford things. Your finances can become unstable at some point in time, however by investing early; you would be able to face such hardships.

3. Become financially disciplined= Your early visit to a financial planner can make you financially disciplined. When you start investing a portion of your salary upfront, you know exactly how much amount you are leftwith. The process of saving would develop the habit of spending less as you would be able to differentiate between your needs and wants. It will boost the financial discipline in your life.

4. Ample time to manage risk= The only certainty about the market is its uncertainty. Time and again, the market has favoured those investors who have long investment horizons. A long investment tenure shields you from market volatility and gives that ‘extra’ time, which your investment or a financial planner may require for mitigating the market risk.

5. Sufficient time to rectify financial mistakes= While the power of compounding can help in growing your money, the flip side is that mistakes can also compound. Most of us have been prey to bad financial decisions. Often, at the onset of the financial planning, while defining our portfolio allocation, we can make mistakes in choosing the investment avenues. Even a financial planner can’t do wonders if the foundation of your investment is at fault.

However, by starting early, you are giving yourself some extra time to correct your past financial mistakes. The other benefit is that since you save less when you are young, your financialmistakes might not be that ‘costly’.

6. Time to find a good financial planner= Considering the intricacies involved in a financial market, it is always best to avail the services of a financial planner who can take you through the zigzags of the market by bringing an ‘objective’ perspective to your ‘emotional’ money issues. While it is essential to have a good financial planner, it is equally important to choose a good planner which you can do only if there is a time to find the one. It’s your hard-earned money, and you should not trust anyone.

7. Wide options to choose from= An early financial planning not only gives ample time to your financial planner to turn the market in your favour, but it also opens many doors for you. For instance, when you have both time and age at your side, you can build a comprehensive financial portfolio that can include equity and debt. However, when the time is a constraint, your financial planner would intentionally keep some options out of your investment portfolio.

Time is free, but its value is priceless, you can’t own it, but you can certainly use it. You can’t keep it, but you can spend it. So, act today to build a secure financial tomorrow!

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.