5 Leading Indian Term Life Insurance Plans & Their Best Features

Being a family person is one job where we always want to excel. Whether it’s about providing for our family, putting their needs before everything else or protecting themalways, we make sure that our loved ones get the life they deserve. But what if we are not there anymore to watch over and protect them? What would happen to their dreams and aspirations?

Any eventuality or unforeseen circumstance can put an abrupt end to your plans for your dear ones. With a term plan; however, you can secure your family’s financial future and make sure that their dreams remain intact,even if something happens to you. Before you set out to buy term insurance online, you need to prepare a checklist of your requirements and use it to determine the most suitable plan from the available options. To help, here are some of the top performing Indian term insurance plans and their best features.

1. Max Life Online Term Plan Plus

Max Life Insurance is the joint undertaking between Max India Ltd and Mitsui Sumitomo Insurance Co. Ltd. With a claim settlement ratio (CSR) of 97.81% in the year 2016-17 (the highest among private insurers for the year) and pending claim percentage of less than 0.03%, Max Life Insurance features some of the most impressive credentials in the insurance sector today. For the year 2017-18, the claim settlement ratio for Max Life Insurance has increased to 98.26%. Their term plan offering, Online Term Plan Plus offers three variants of its basic life cover along with an array of benefits including increasing monthly income to your family after your demise. Unique features and benefits of the plan include:

• Lump sum and monthly income payout option

• Additional rider options to maximisethe plan benefits

• Opportunity to increase coverage at important milestones

• Maximum insurance coverage up to 85 years

• Availability to the NRI population in selected countries

2. LIC’s Jeevan Pragati Plan

Life Insurance Corporation of India, the oldest life insurance company in India, was set up in the year 1956. Headquartered in Mumbai, LIC is owned by the Government of India and has more than 2048 branches across the Indian subcontinent and boasts of a death claim paid percentage of 98.55 for the year 2017-18, thus making it the front-runner of the insurance sector in terms of popularity. LIC’s pureterm offering Jeevan Pragati Plan is an online insurance policy that only offers the death benefit. Key features of this plan include:

• All types of death covered under the plan, including accidental death

• No additional riders

• No options to avail loanagainst this policy

• The plan provides life cover up to 75 years of age

3. SBI Life eShield

SBI Life is another insurance company that has a widespread presence across the country, besides LIC. Started as a joint venture between the State Bank of India and BNP Paribas Cardiff S.A., SBI Life Insurance Co Ltd was established in the year 2001. Today, the company’s roster of insurance plans ranges from individual plans to online and group plans, while boasting of a claim paid percentage of 96.69 (for the year 2016-17). That said, the eShield plan from SBI Life is a pure term plan that differs from the LIC’s Jeevan Pragati Plan in certain aspects. Some of the outstanding features that the plan has to offer include:

• Option to choose between a life cover and an increasing cover benefit

• An inbuilt accelerated terminal illness benefitsalong with two rider options

• Discounts on the policy premium for a non-smoker

4. Aegon Life iTerm Plan

Aegon Life Insurance Co Ltd, a venture of Aegon and Bennett, Coleman & Company, India’s most prominent media conglomerate, was founded in July 2008. Its headquarters are in Mumbai, and the company has a customer base of more than 4.4 lakh people across India. Moreover, the insurers boasted a claim settlement ratio of 97.11% in the year 2016-17. Their term plan offering, iTerm Plan offers one of the lowest rates of premium among insurance plans in India and is also the only policy to provide coverage up to 100 years of age. Standout features of the iTerm plan include:

• Option to choose between a fixed monthly income for 100 months and a lumpsumpayout

• Maximum life cover up to 100 years

• An inbuilt terminal illness benefit

• Minimum sum assured of Rs. 25 lakhs

5. ICICI Prudential iProtect Smart

Featuring last on our list of best term insurance plans in India is the iProtect Smart from ICICI Prudential. ICICI Prudential boasted of a claim settlement ratio of 96.68% for the year 2016-17. Coming to the term plan, it offers a 360-degree coverage at a very reasonable cost. Also, you can claim payment on diagnosis of 34 critical health conditions. Here are some of the distinctive features and benefit of this plan:

• Options to choosethe payoutfrom lump sum,fixed monthly income and increasing income

• Terminal illness benefit included in the plan

• Option to add accidental benefitthrough riders at the later stage

Concluding,

We may not be that great an orator, thinker or influencer, but we always strive to be the best at being a parent and a family person. We take care of our family and work hard to give them a thriving present and a financially secure future. With a term plan in your investment portfolio, you can be sure that your family wouldn’t have to depend on anyone else financially, should anything happen to you. Term plans work as a long-term investment option, providing you with life cover against any eventuality throughout the policy period.

That said, it is also a fact that poorly chosen term insurance plan often proves worthless in times of need since you’ve not considered your requirements before buying one. Therefore, you need to list your requirements in a checklist and make sure that you make comparisons between all available insurance offers.

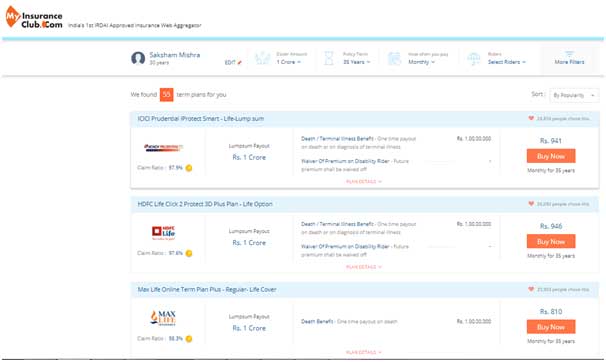

When it comes to choosing a low-cost term plan with high coverage amount, no other insurer comes to mind but Max Life Insurance. As evident from the various term plans in this list, Max Life offers a comprehensive insurance policy that offers the lowest premium rates, while featuring the highest claim paid percentage among top insurers. Also, these plans offer a coverage period of up to 85 years of age, along with benefit payment for up to 40 critical illnesses and disabilities. For instance, if we are opting for term plan with a sum assured of Rs. 1 crore and 35 years of coverage, Max Life offers the Online Term Plan Plus for a monthly premium as low as Rs. 810 (refer screenshot below)

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.