4 insurance policies you must buy

Most people rely on their employment covers that are automatically available and therefore, do not make any effort to weigh and choose other options that are now easily available online.

Any insurance is considered as profitable only in case of unforeseen circumstances and most people falsely believe that nothing uncertain or unfortunate will happen to them, their family or their property. But, what is the guarantee? Uncertain events are not in anyone’s control and therefore, insurance covers should be the most sought-after policies to support your family and your property.

Although there are various insurance covers available, the four policies that you must avail at any age are as follows:

1.Term Insurance

You may believe that the chances of death of the breadwinner of the family are very rare or almost impossible. This is a common positive belief that most families rear because of the good health of the individual. But, who can deny the uncertainty that comes along with it?

The death of the breadwinner of the family can ruin the prospects of the whole family. Imagine the burden of the long-term loans or costly assets in the absence of a source of income. Moreover, if the children are still completing their studies, the untimely death of a family member can ruin their future as well. It is thus; better to avail a suitable term insurance for yourself in order to save your family from the immediate expenses or till an alternate source of income is arranged in case of such an unfortunate incident.

There are several term insurance plans available nowadays that can be easily availed online. If you are in your 30’s, it will be better to take up this cover for a longer term (more than 30 years) so that you have the protection till your old age when you need it the most. It is also important to study all the important aspects of your life in order to choose the best life cover.

2.Health Insurance

Next in line is the health or medical insurance. This is an important cover that you can buy for yourself or your whole family in the form of family floater health insurance. With increasing medical and hospitalisation expenses, you need to be prepared for any unexpected illness in the future,and health insurance is the best way to prepare yourself for hefty medical expenses.

If you have old-age parents who are dependent on you, you must avail independent health insurance for them. This is because the premiums of family floater plans depend on the age of the insured persons. So, higher the age of anindividual in a family floater plan, more will be the premium.

Source: The Economic Times

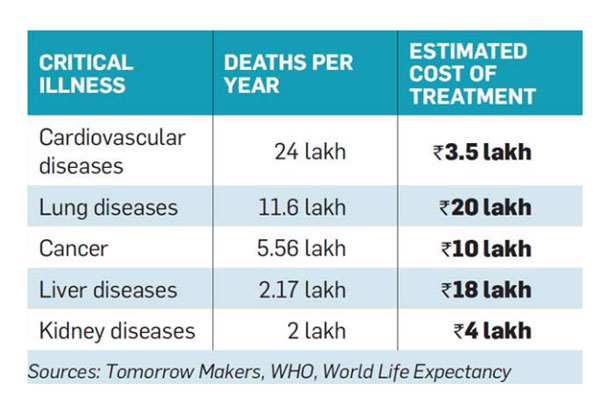

A family floater plan can be availed if you are married or planning to have a child. Some of these covers also include the maternity and baby care expenses. In cases of long-term illnesses like liver disease or cardiovascular problems, you cannot solely rely on your income or the group cover offered by your employer. In such cases, you can also go in for critical illness insurance covers and super-top-up plans.

3.Accident and Disability Insurance

Accident and disability insurance cover is often not on the priority list of anyone. It is the least sought-after cover despite the high risk to life and body when one travels by any mode of transport. No one thinks about an accident that is coming their way and the most horrible outcome can be death or disability.

This unfortunate incident can ruin the life of the entire family and leave them under the burden of medical expenses. Moreover, if a breadwinner becomes disabled in an accident, the income of the family also stops but other household expenses remain constant. It is better to avail a cover for the benefit and comfort of your family in such a case.

4. Home and Content Insurance

Your home is your biggest asset as it protects you from unforeseen harsh weather conditions and human dangers. But, have you ever thought to protect your home from unforeseen events like fire, terrorism, earthquake or flood? Have you ever thought to protect the costly assets kept in your home?

If not, it is time to ponder. There are certain areas that are prone to destruction by cyclones, floods, riots etc. Also, a burglary cannot be ruled out completely even if we think that we live in well-guarded localities. It is better to avail a comprehensive home insurance policy to protect your house from all types of man-made and natural calamities.

But, you need to be aware of important inclusions and exclusions that come along with such insurance.

So, these are the four most important insurance policies that you must avail for a secure life and future for yourself and your family.

Support Our Journalism

We cannot do without you.. your contribution supports unbiased journalism

IBNS is not driven by any ism- not wokeism, not racism, not skewed secularism, not hyper right-wing or left liberal ideals, nor by any hardline religious beliefs or hyper nationalism. We want to serve you good old objective news, as they are. We do not judge or preach. We let people decide for themselves. We only try to present factual and well-sourced news.